My recent keynote topic at a Women Corporate Directors event was “The Brains of the Board — How to Drive an Effective Board.” Much of my discussion centered around neurochemistry, in turn, sparking conversations about gender differences in the brain and then segued into the all-so-familiar topic of diversity in the boardroom.

Gender diversity invokes sundry perspectives on how to solve problems companies face efficiently. To that end, companies with more women on their boards set the tone for a more inclusive workplace culture from the top of the organization. Also, companies with at least three female board members see median productivity of 1.2% above competitors.

Now is the point in such an article where you see the author turn to how the positive effects of women on boards are being ignored and that we are still suffering and will continue to suffer — the status quo. Not so. The cracks are becoming more and more evident, and as always happens with a cracking structure, once the fissures grow enough, the entire structure falls.

Here are long-term shifts that are building diversity in the boardroom.

Changes In Perception

Old behavior: “We don’t need a woman director because we are not a consumer-facing company.” This was a commonly heard statement at board planning meetings.

New behavior: Nearly a third of global S&P 500 boards now include three or more women. What’s more, the ratio of companies with three or more women on the board has grown from 19% in 2015 to 29% in 2018.

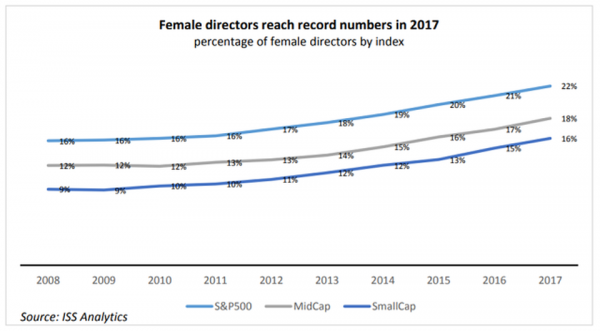

These changes suggest that boards with diversity recognize the value it adds to board decision making and performance. By 2020, a common goal is to reach over 30% of public company boards being composed of females. The Breakfast of Corporate Champions, an event I often attend, annually honors companies and leaders actively advancing women on corporate boards. At a National Association of Corporate Directors meeting, Institutional Shareholder Services (ISS), a proxy advisory and corporate governance firm, shared a change in their routine. Their areas of measurement in 2019 are gender, skills/background, ethnicity, age, and tenure. There will also be a keen focus on directors’ compensation, environmental, social and governance, and board diversity. According to CNBC, “Starting in 2020, ISS will vote ‘No’ on the re-election of Nominating and Governance chairman if their company does not have at least one woman on their board.”

Changes In Pipeline/Position

Old behavior: There aren’t as many qualified women to serve.

Many boards required their members to serve as CEO before serving on the board. Yet women make up just 5% of Fortune 500 CEO positions due to a 25% drop in 2018, placing a strain on these requirements.

New behavior: The standards for serving on a board are changing to reflect a diversity of mindset versus a qualification of having been CEO of a public company. Investors are focusing on the quality and effectiveness of board decisions, thus bringing gender diversity into the mainstream of proxy behavior. According to a Catalyst study, companies with the most women directors have a 26% higher return on invested capital than those with the least.

Fortunately, a growing number of companies are taking matters into their own hands to effect societal change. These companies encourage business leaders to disclose how many women are in the pipeline toward board membership. Since it installed the Fearless Girl statue on Wall Street in 2017, State Street Corporation has urged over 700 companies with exclusively male boards to share this information with the public. Hundreds of those companies have already added at least one woman to their board or have pledged to do so. Furthermore, our firm, Berdéo Group, has joined with Accenture, Bank of America, Salesforce, SAP, Anthem and many other companies in the pursuit to accelerate the pace of achieving gender parity by 2030 through the Paradigm for Parity.

Another development is the Bloomberg launch of its 2019 Gender-Equality Index (GEI), which, this year, selected 230 companies “committed to transparency in gender reporting and advancing women’s equality in the workplace.” According to Bloomberg, “women had a 40% increase in executive level positions between fiscal years 2014 and 2017.” This spawns from a growing number of investors being willing to oppose boards that they perceive as insufficiently diverse.

Lastly, California is the first state requiring publicly held companies to have at least one woman on their board of directors by the end of 2019. The changes won’t end there. By the end of 2021, companies must have a minimum of two women on boards of five members and three women on boards of six or more.

Continuing The Trend

For all these wonderful developments to cascade in an even more positive direction, company leaders, of course, need to take ownership of gender diversity, not only by appointing more women to boards but also by implementing more rigorous inclusivity practices to combat biases. Educating managers and executives on the impact of stereotyping and giving them the tools to break down unconscious behaviors are also integral to real change. Finally, as proposed by the EY Center for Board Matters, boards should consider whether their proxy statement showcases the board’s diversity and discloses diversity goals to help demonstrate the value the board places on diversity.

long with women in the boardroom, 2018 was extremely positive for women in politics, and with their influence, I believe that we will start seeing more and more positive board trends. Through visible commitments at both the government and corporate levels, gender diversity will grow, and gender biases will diminish. While threading the needle between patient and assertive, logic-based advocacy is still key to forward progress, a new day is on the horizon!

This article originally appeared on Forbes Feb 13, 2019.